The Reserve Bank of India’s (RBI) & the (MPC) Monetary Policy Committee unanimously resolved on Thursday to maintain the policy repo rate at 6.5 percent while remaining prepared to take actions if the need arise. This decision was based on the overall economy and its forecast.

As a result, the bank rate and the rates for the MSF and SDF will both stay at 6.75 percent.

The Monetary Policy Committee also resolved to continue concentrating on the withdrawal of accommodation to make sure that inflation gradually aligns with the objective while promoting growth, with a majority of Five out of Six members.

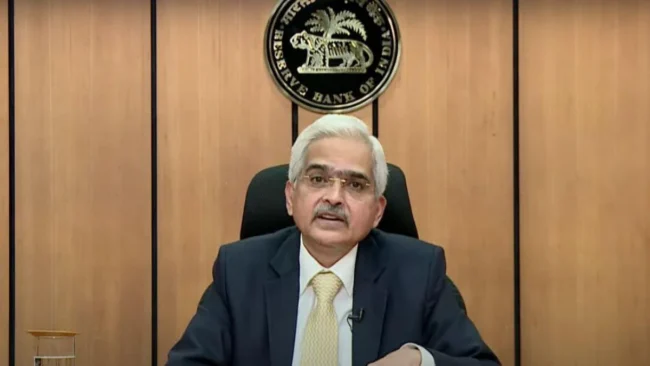

In his monetary policy announcement, governor Shaktikanta Das provided an explanation of the MPC’s thinking behind these decisions regarding the policy rates and outlook.

Although current higher frequencies indicators point to modest improvements in worldwide economic activity. The prognosis is now temper by extra downside risks due to worries about financial stability.

“Inflation is declining, but it is still significantly higher than central banks goals”.

According to substantials 2-way, these changes have increased market volatility globally, he said.

He claimed that despite the volatility, India’s banking & non-banking financial services industries are still strong. And that the country’s financial markets have developed in a controlled way.

Gross Domestic product (GDP) growth is anticipated to have been 7 percent in 2022–2023 as the economy continues to be resilient. Nonetheless, price pressures in cereals, milk, & fruits have intensified since Dec 2022, contributing to consumer price inflation. Core inflation is still high, he noted.

The Reserve Bank of India’s (RBI) Steps to Tame Inflation

He claimed that given the effects of the monetary policy decisions made since May 2022 are still being felt throughout the system. The (MPC) Monetary Policy Committee opted to maintain the policy rate. As is in order to assess the progress made thus far and closely monitor the changing inflation outlook.

He emphasised, “The Monetary Policy Committee will not hesitate to take such measures as may be necessary in its future meetings.

According RBI Governor to Mr. Das, the outlook is at danger due to the ongoing geopolitical tensions and the volatility of the global financial markets.

The real growth in gross domestic product for 2023–2024 is predicted to be 6.6 percent. With 1st quater growth of 7.9 percent, 2nd quater growth of 6.3 percent, 3rd quater growth of 6.2 percent. And 4th quarter growth of 5.9 percent. He claimed that the risks were balance fairly.

Speaking on inflation, Mr. Das noted that the pressures of imported inflation. And the growing unpredictability of global financial markets need to be closely watch.

Given a number of variables, an average yearly crude oil price (Indian basket) of 85 dollar per barrel, and a regular monsoon. It is predicted that Consumer price inflation will moderate to 5.3 percent for 2023–2024.

With 1st quarter values of 5.2 percent, 2nd quater values of 5.5 percent, 3rd quater values of 5.5 percent. And 4th quater values of 5.3 percent. The dangers are fairly distribute.