The upcoming Federal Reserve policy meeting, scheduled for September 19-20, is shrouded in uncertainty as the U.S. economy delivers mixed signals. August’s labor market data revealed nonfarm payrolls increased by 187,000 jobs, surpassing economists’ expectations of 170,000 but showing a slowdown in wage growth from 0.4% to 0.2% month-on-month.

Moreover, the unemployment rate in the world’s largest economy unexpectedly crept up to 3.8%.

Complex Labor Market Signals Complicate Fed’s Path

This puzzling jobs report adds complexity to the emerging narrative of a cooling, yet still tight, U.S. job market. While U.S. private payrolls grew by 177,000 in August, below the forecasted 195,000, data suggests there were 1.51 job openings for every unemployed person in July.

This ratio indicates a labor market that, while modestly cooling, continues to offer ample opportunities for job seekers, potentially alleviating inflationary pressures.

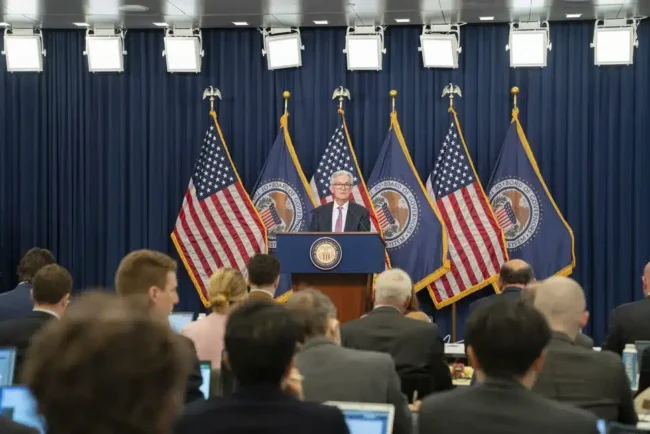

Federal Reserve policymakers closely watch these labor market developments. They seek signs that the cooling trend persists without becoming detrimental to the broader economy.

The Fed’s strategy has been to raise interest rates to moderate labor demand and temper wage growth to curb inflation.

Despite speculations about an impending shift in the central bank’s stance. The exact path the Fed will take after the September meeting remains uncertain.

The Fed has consistently emphasized its data-dependent approach when making decisions. Given the recent data, the expectation for a rate hike during the upcoming meeting is minimal. Analysts argue that the August jobs report, combined with slowing inflation, does not support an interest rate increase in September.

In conclusion, the U.S. job market has shown moderate growth, subdued wage pressures, and an uptick in unemployment, reflecting a labor market that’s gradually slackening.

Coupled with the ongoing trend of slowing inflation. It appears unlikely that the Fed will raise interest rates in its September meeting. The complex labor market signals create a challenge for the Federal Reserve as it deliberates on maintaining current borrowing costs.