Copper Yesterday closed up 1.25% to 777.5 as market players maintained optimism about a revival in demand in major consumer China. Prices were boosted by expectations that China’s metal consumption will eventually increase after the country lifted the severe COVID-19 limits.

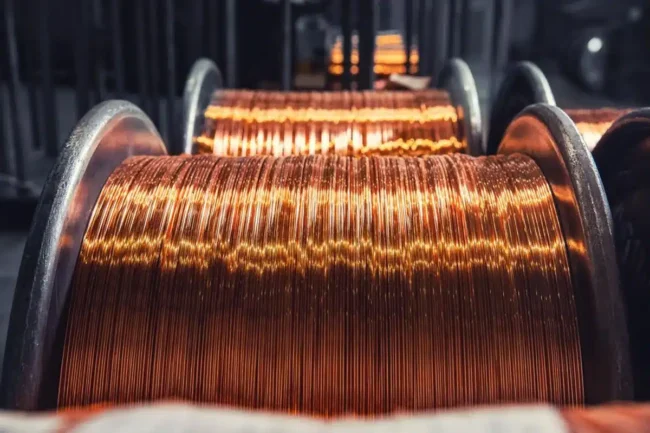

According to the International Copper Study Group (ICSG). The refined copper market saw a shortfall of 89,000 tonnes in Nov as opposed to a surplus of 68,000 tonnes in Oct. In Nov, the world produce 2.2 million tonnes of refined copper, whereas 2.3 million tonnes were consume.

According to the ICSG, the market had a 384,000-tonne shortfall through the first 11 months of 2022 as opposed to a 381,000-tonne deficit through the same period last year.

In January, Yangshan copper premiums under warrants averaged $33.5/metric tonnes, down $20.39/mt from the previous month. While under bills of lading, they were $24.38/mt, down $22.8/mt.

Due to the fact that the ratio of the SHFE – LME copper price has not been greatly improved. Import losses have reached 500–700 yuan/mt as of Feb.

The number of Americans applying for unemployment benefits fell to 194,000 during the week ending Feb 11th, down from 195,000 the previous week and falling short of market forecast of 200,000.

The consumption of metals like copper, Zinc and lithium is expect to continue growing. According to several experts and portfolio managers. That’s because they are important for producing the solar panels, batteries, and wind turbines required for the move from fossil fuels.

Yet, due to mining firms’ sluggish output growth, many also expect a supply gap between supply and demand.

One of the largest copper miners in the world, Freeport-McMoRan, stated on a recent results call. That it would increase its capital investment for 2023.

Analysts expect that the industry will continue its aggressive share repurchase programme from the previous year.

According to Freeport CEO Richard Adkerson, “the world today does not have enough copper.”

“There is a serious shortage of copper compare to a large increase in demand.”

Although natural gas accounts for about 25% of residential energy demands, falling natural gas prices are reducing some of inflationary pressure in America.

According to the most recent official data released earlier this week. Inflation in the United States decreased in Jan for a 7th straight month. Although the rate of drop appears to be slowing down. For the still-sticky inflation to continue its downward trajectory, the Fed may need to raise interest rates further.