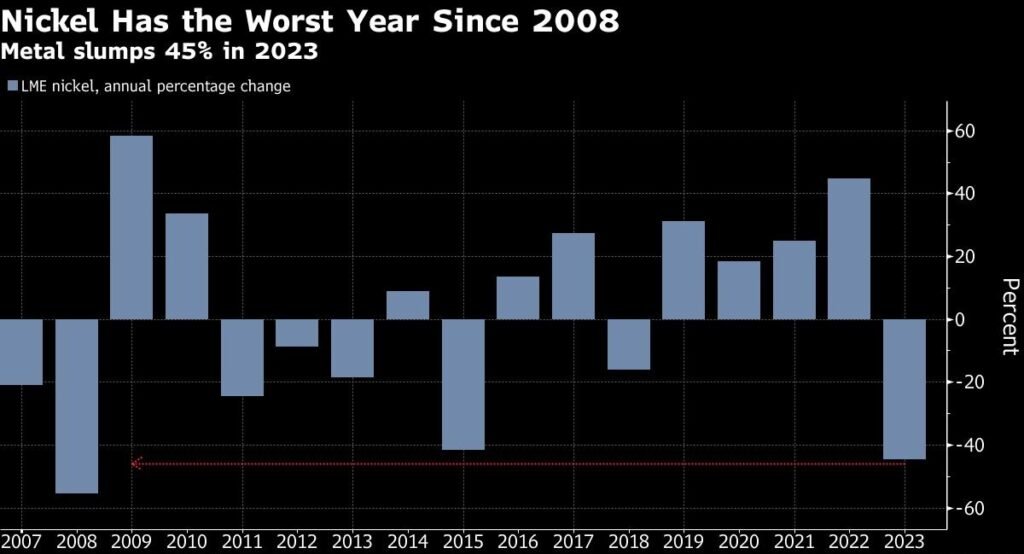

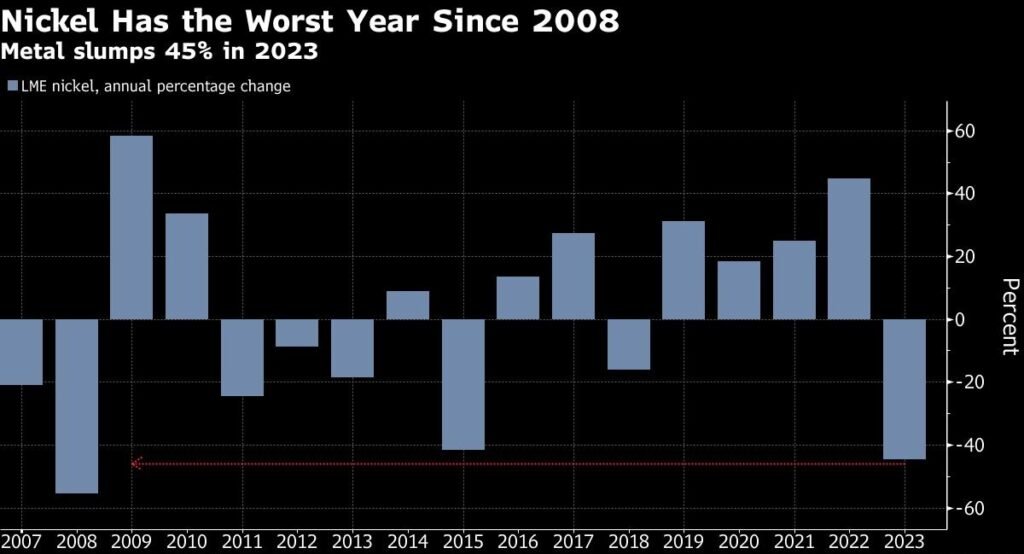

Nickel was the worst performer in a year that was largely dull for metals trading, and there may not be a break anytime soon. The London Metal Exchange reported a 45% annual decline in the metal used in electric vehicle batteries and stainless steel, the largest decline since 2008.

That is by far the worst result for industrial metals, and it is in stark contrast to gains of 2.2% for copper and roughly 20% for iron ore in Singapore.

This year, concerns about China’s growth prospects and global economic headwinds have put pressure on metal prices. It is the second annual fall for the LME’s all-in gauge of 6 metals, which is lower 5.6% for the year.

Supply and Demand Dynamics: Nickel Faces Ongoing Challenges

Most of the time, worries about supply constraints or even shortages have turned out to be unwarranted or possibly even premature. However, those concerns were especially valid for nickel, a market that has recently seen an influx of fresh material from Indonesia, the world’s largest producer. Growth in demand has also slowed.

In a note published on its website, Huatai Futures analysts stated, “Nickel supply is continuing to grow, but consumption is showing no sign of improvement.”

Traders are still placing bets against nickel. The top twenty traders on the SHFE currently have the largest net-short positions on the metal in at least six months.

A fourth-quarter rally that was aided by expectations that the Federal Reserve would begin lowering interest rates next year is what led to copper’s annual gain. In a note dated December 18, Goldman Sachs Group Inc. predicted that prices would reach $10,000 per metric tonne in the next 12 months.

Copper fell 0.8% to close at $8,559 a tonne on the last trading day of 2023, while nickel also dropped 0.8% to close at $16,603 a tonne.