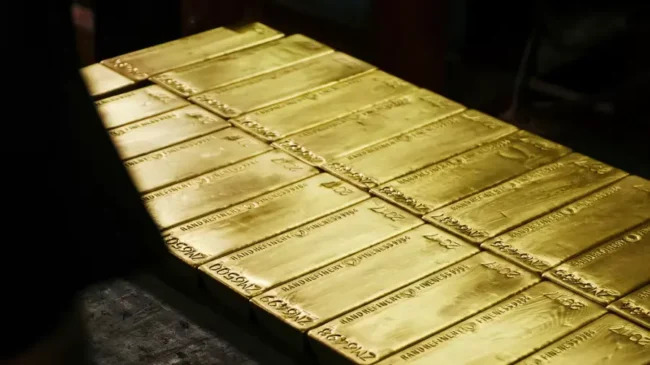

Gold prices update: prices dipped 0.33% to settle at ₹78,166, weighed down by robust U.S. jobs data and a stronger dollar, which tempered expectations of aggressive Federal Reserve rate cuts.

- U.S. Economic Data Impact: The nonfarm payrolls report revealed 256,000 new jobs in December, the highest since March, easing market expectations for 2024 rate cuts from 40 basis points to 25 basis points.

- Key Upcoming Indicators: The Fed’s monetary policy direction awaits further input from U.S. CPI, PPI, jobless claims, and retail sales data due this week.

- Physical Market Activity:

- India: Gold discounts rose to $17/oz as domestic prices hit a monthly high, curbing demand.

- China: Lunar New Year festivities spurred demand, with premiums ranging from $2 to $9/oz.

- Other Markets: Premiums in Singapore, Hong Kong, and Japan reflected mixed demand, with ranges of $0-$2.50/oz.

- India: Gold discounts rose to $17/oz as domestic prices hit a monthly high, curbing demand.

- Central Bank Purchases: November saw a 53-tonne increase in reserves, led by Poland (21 tonnes) and India (8 tonnes). China resumed purchases, raising reserves to 73.29 million ounces.

Technical Overview:

- Support Levels: Immediate support is seen at ₹77,935, with a potential decline to ₹77,695.

- Resistance Levels: Key resistance stands at ₹78,590, with a breakout possibly reaching ₹79,005.

- Market Dynamics: Open interest fell 6.16% to 10,488 contracts, indicating long liquidation pressure.

We also provide rates for other cities.

- MUMBAI SCRAP PRICES

- ZINC SCRAP PRICES

- DELHI LOCAL SCRAP PRICES TODAY

For the Current Gold Prices Update, make sure to click here :- CONTACT NOW

SHREE METAL PRICES