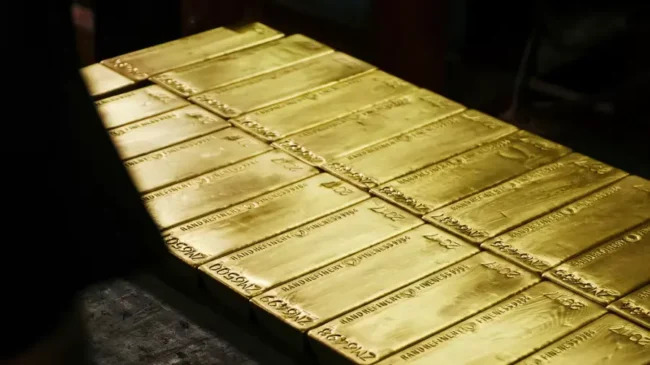

Tuesday’s increase in gold prices followed several days of strong gains in 2023, as traders welcomed the possibility of an early 2024 Federal Reserve (Fed) interest rates cut.

Spot prices for the yellow metal were trading roughly $70 an ounce below a record high set at the start of December, as investors increased bets that the bank may start reducing rates as early as March 2024 in response to dovish signals from the Fed.

However, the expectation of additional December U.S. economic data, especially the important nonfarm payrolls statistics, which is scheduled for release later this week, restrained further gains in gold.

Gold futures expiring in February increased by 0.3% to $2,078.90 an ounce by 23:36 ET (04:36 GMT). While spot gold increased by 0.3% to $2,069.89 an ounce.

The primary focus of the markets was on the nonfarm payrolls data for December. Which is schedule for release this Friday. The labour market is predict to continue cooling. Which would increase pressure on the Federal Reserve (Fed) to think about lowering interest rates sooner rather than later.

Traders are pricing in a more than 70% chance that the Fed will reduce rates by 25 bps in March. According to the CME’s Fedwatch tool. However, the central bank still has to deal with a plethora of economic data before the March reading, especially regarding inflation and the labour market.

Even after the labour market and inflation both experienced significant downturns in 2023. Price pressures remained significantly higher than the Federal Reserve’s 2% annual target. Additionally, the work area was getting pretty hot.

Federal Reserve Faces Dilemma Amid Economic Challenges

In December, Fed representatives issued a warning, stating that further cooling in the two trends would be necessary before the central bank would consider reducing interest rates. Additionally, officials cautioned that wagers on the Fed’s early rate cuts were unduly optimistic.

However, it is still widely anticipate that the Fed will eventually lower interest rates in 2024. Which is good news for gold because investing in the yellow metal becomes more expensive at higher yields. Gold was severely damaged by this trade for the majority of 2023 before a robust rebound in December.

Tuesday saw a minor increase in the price of copper among industrial metals as investors continued to be optimistic about increased demand and more competitive copper markets in 2024. However, statistics from China, the world’s largest importer of copper, indicated persistent economic weakness, undermining this theory.

March expiration copper futures increased 0.2% to $3.8973 per pound, following a 2.1% increase in 2023.

China’s official purchasing managers index statistics revealed that while non-manufacturing activity was almost flat in December. Manufacturing activity contracted more than anticipated.

A private survey revealed that the manufacturing sector was still relatively resilient, but growth was still modest. Both inflation and employment declined in December.

According to the readings, business activity in the top copper importer in the world continued to be weak, a trend that could hurt copper demand in 2024.

Although supplies are predicted to tighten due to significant mine closures in Peru and Panama. Prices of the red metal are still predicted to benefit from rising demand for green energy and electric vehicles.