The cost of energy has increased in Europe by over USD 1 trillion as a result of Russia’s war in Ukraine. And the biggest crisis in decades is really just getting started.

The region will need to replenish their gas supplies after this winter with little or no supply from Russia. Which will make it more difficult for fuel tankers to compete. The market is anticipat to be constrain until 2026.

When more production capacity from the United States via Qatar is available, despite the advent of more liquefied natural gas import facilities. That means there will be no reduction in the high cost.

Governments were able to minimize the impact on businesses and consumers by providing more than USD 700 billion in aid. But a state of emergency might persist for years. According to Brussels-based research tank Bruegel.

The help that has eased the blow for millions of individuals and companies appears to be growing more and more out of range given the rising interest rates and the likelihood of recession.

According to Martin Devenish, director at consultancy S-RM, “When you add it all together — bailouts, subsidies — it’s an absurdly big number of money,” adding that the Government will find it significantly challenging to manage this situation next year.

The estimated figure of USD 1 trillion based on market data represents an overall accounting of higher energy costs for individuals and businesses, some of which. But not all, offset by relief packages.

Base on both demand and price inflation, Bruegel has a comparable estimate that was just release in an IMF report.

EU Struggles with High, volatile Energy prices

While near-record prices, a race to fill storage past summer has temporarily relieved the supply crunch; nevertheless. This winter’s bitterly cold temperatures are putting Europe’s energy grid to the test.

The network regulator for Germany issued a warning last week, noting that two of five indicators, including levels of consumption, have hit critical levels and that not sufficient gas is being saved.

Businesses and customers have been encourag to cut back on their usage because the supply is constraine. The EU was able to lower gas consumption by 50 billion cubic metres in the year. But the region still faces a projected 27 billion cubic metre shortage in 2023.

As reported by the International Energy Agency. Assuming that Chinese LNG imports recover to levels seen here in 2021 and that Russian supplies are completely go.

The hunt to fill EU natural gas reserves before the upcoming winter has begun. According to Bjarne Schieldrop, senior commodities analyst of Swedish bank SEB AB. Who predicts a “seller’s market” for at least a next 12 months.

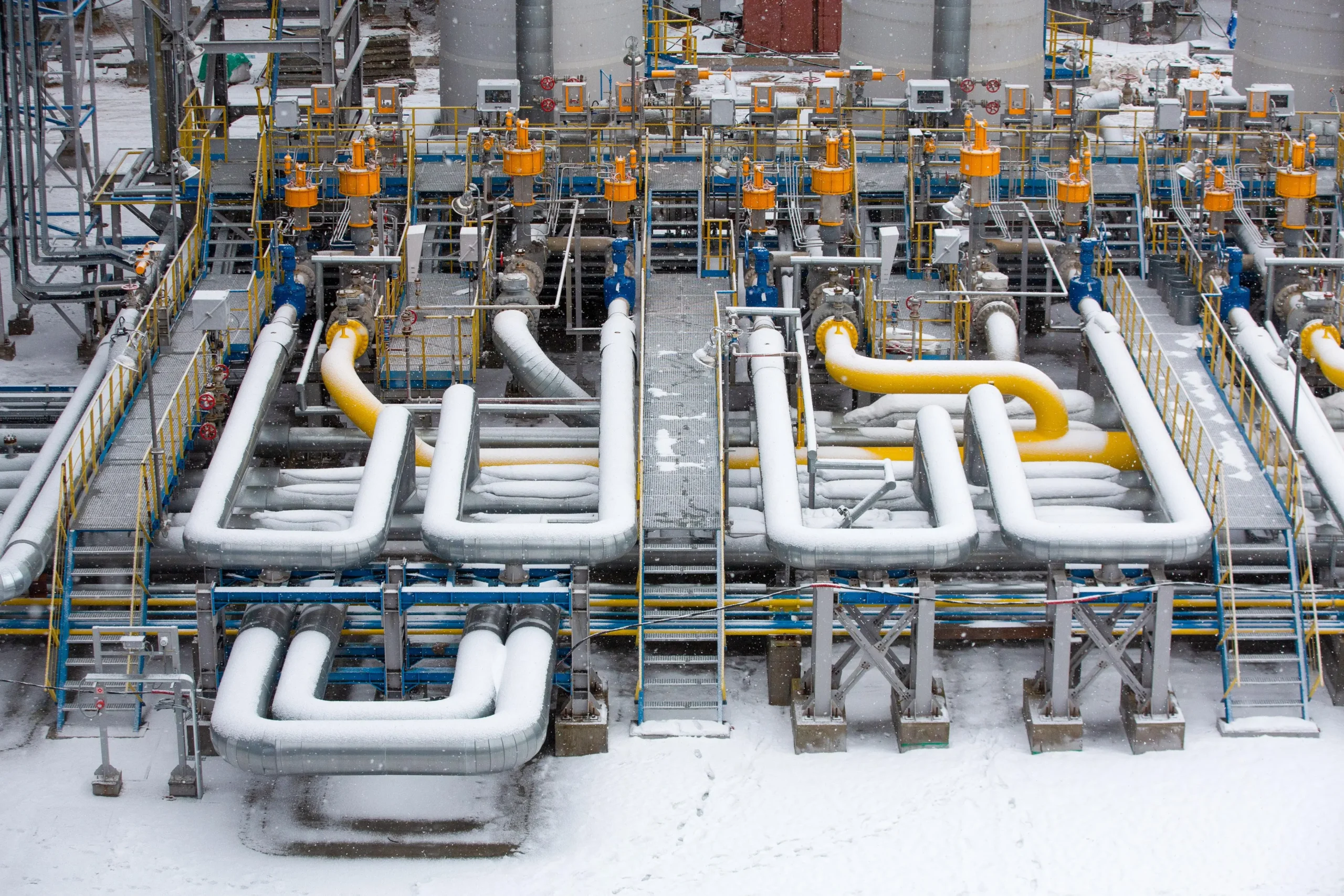

In September, sabotage damaged Nord Stream, the primary pipeline carrying gas from Russia onto Western Europe. Despite the Kremlin’s massive shelling of Ukraine’s energy infrastructure, the region still receives a limited amount of Russian supply via that country. Without this gas line, it will be difficult to refill storage.

The European Commission have established minimum inventory targets in order to prevent a shortage. By 1 February, reservoirs should be minimum 45% fill to prevent depletion by the conclusion of a heating season.

The objective is to have 55% of the storage levels at a certain point if the winter is moderate.

The amount of LNG (liquefied natural gas) being import into Europe is at an all-time high, and new floating terminals are now accepting the fuel in Germany.

Government-backed purchases have made it easier for Europe to entice cargoes away from China. But the region’s colder climate and a prospect for a robust economic recovery in the wake of Beijing’s easing of Covid restrictions could make that far more challenging.