According to the Economic Survey 2023, exports may slow and weaken as a result of a possible worldwide economic recession. The survey issued a warning that “complex international commodity prices & disturbances in raw material supply could pressure on industrial growth in the face of further challenges at the global level.”

Additionally, it issued a warning that the reawakening of Covid-19 in China would cause supply chain disruptions.

Despite global challenges, industrial production increased in FY23, supported by persistent demand conditions. Significantly, the survey revealed that bank lending has kept up with the expansion of industry.

Since January 2022, bank lending has been increasing consecutively.

Foreign direct investment (FDI) here in the manufacturing sector declined during the first half of FY23, reflecting global uncertainty. But inflows remained far higher than they were before the outbreak.

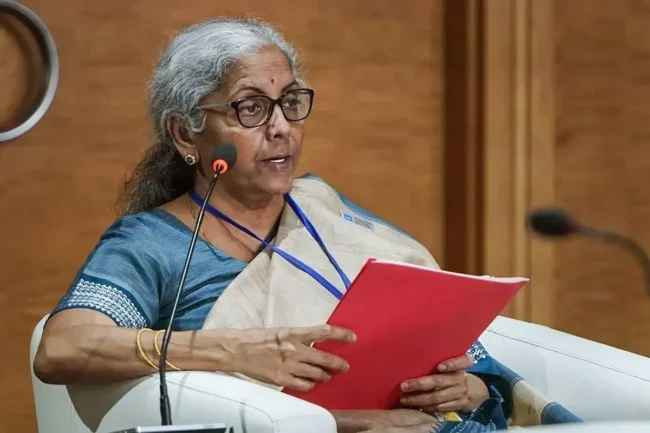

Following President Droupadi Murmu’s speech to both Houses of Parliament on Tuesday. Finance Minister Nirmala Sitharaman introduced the Economic Survey inside the Lok Sabha.

According to the most recent Reserve Bank of India (RBI) data. India’s current account deficit increased to 4.4% of GDP in the quarter ending in September from 2.2% of GDP there in quarter ending in April-June as a result of a larger trade imbalance.

A quick recovery that is largely driven by domestic consumption and to a smaller extent by exports poses downside risk to the trade balance, according to the Survey, which also noted that “CAD requires to be carefully monitored because as growth momentum of current year drops off into the next.”

The trade deficit has widened in 2022–2023 as a result of import growth outpacing export growth at this point.