Due to Beijing’s restrictions on financing for large-scale oil projects, loans made by China’s two primary trade policy banks reached a 13-year lowest of $3.7 billion in 2021. According to a Boston University Global Development Policy Center survey.

Export Import Bank of China and China Development Bank commitments to 100 poor countries have decreased each year since reaching a record by 2016. As the lenders reduced financing before the COVID-19 epidemic struck in 2020.

According to Kevin Gallagher, director of university Global Development Policy Center. “We anticipate a general move toward smaller volume, better quality investments from China.”

Given the enormous debt and currency swings that may require the requirement to be conservative in dollar holdings in order to act as protection on the home front. China’s domestic concerns over COVID-19 are still important.

According to data from the World Bank, China is the biggest bilateral lender globally. Beijing is under pressure from multilateral lenders and Western nations like the United States to reduce debt for struggling emerging economies like Zambia and Sri Lanka. China frequently withholds information about the terms of its loans and how it bargains with debtors.

Between 2008 to 2021, China EximBank & CBD pledged $498 billion in global loan pledges, as a component of Beijing’s “Belt & Road” development plan.

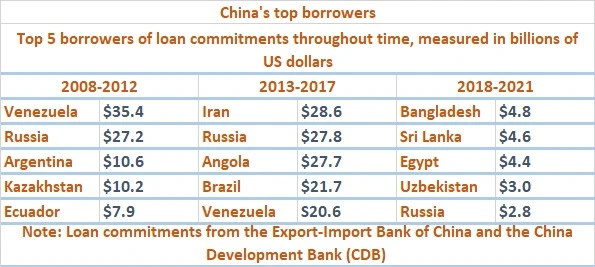

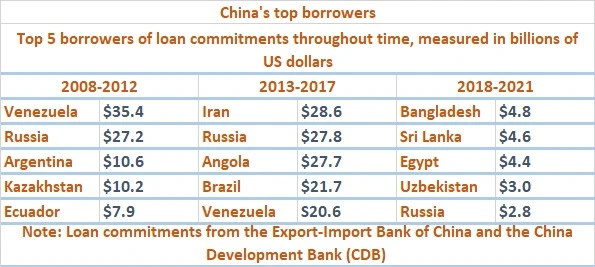

Between 2009 to 2017, general purpose financing to state-owned oil corporations surpassed $60 billion, including in Russia, Angola, Ecuador, Brazil, and Venezuela.

Since then, the emphasis on financing to petroleum producers has decreased, with Bangladesh and Sri Lanka being among the top recipients. Additionally, the average loan commitment size decreased from $534 million between the 2013 and 2017 to $378 million between 2018 and 2021.

THE WORLD BANK GETS INVOLVED

In the 2008 to 2021 period, Russia received the most loans ($58 billion), pursued by Venezuela ($55 billion). Which was primarily use for extraction as well as pipeline projects. However, lending to the South American oil giant came to an end in 2015. 2 years before it went into default on to its foreign debt.

With $33 billion towards projects in transportation, agriculture, water, & oil, Angola was indeed the continent’s third-largest recipient behind Ethiopia, Kenya, and Egypt.

The analysis discovered that while World Bank funding has increased, Chinese lending has been declining.

Before ramping up its reaction to the epidemic in 2020 when it jumped in with $67 billion. Its greatest annual investment since 2008.

The Washington-based lender supported projects in developing nations worth an averaging of $40 billion yearly during 2016 – 2019.

Almost $62 billion in agreements were made the following year, which is 17 times higher than Chinese financing.

According to Gallagher, “The World Bank had the fix sum of lending capability. But this was expedit as part of a COVID-19 reaction,” adding that this might resume trend following the epidemic.

In total, China committed 83% of $601 billion that World Bank lent from 2008 to 2021.

This month, the World Bank planned to discuss with shareholders on ideas including a capital increase and new lending instruments before meetings in April in order to greatly improve its lending ability to confront climate change as well as other global crises.