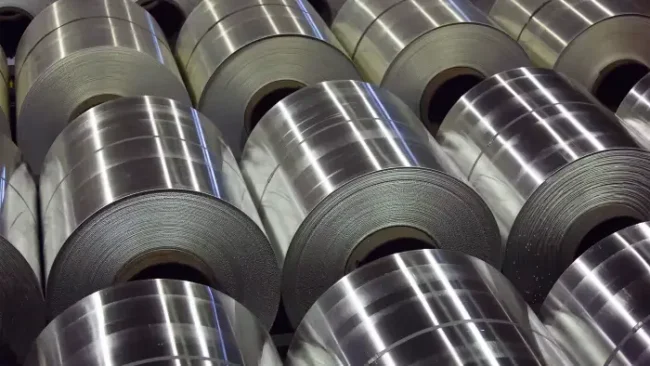

Aluminium prices rose 0.02% to 203.15, as traders stayed cautious about possible EU import sanctions on the biggest manufacturer Russia following Moscow’s invasion of Ukraine. Concerns about the market were heightened by calls from Poland or the Baltic states for the European Union (Eu) to forbid imports of Russian aluminium. 90.4% of the available aluminium stocks in LME-registered warehouses were of Russian origin in December.

The Chinese government is planning to mobilise roughly 2 trillion yuan in order to stabilise the collapsing stock market. The nation’s cabinet promised to implement practical steps to increase investor confidence. Such as bringing medium- and long-term capital into the capital market.

IAI statistics shows that global primary aluminium production reached 6.041 million tonnes in December, up 2.1% YoY.

China became the world’s biggest consumer market for aluminium in 2023. Accounting for 3.06 million metric tonnes of imports, a 28% increase due to strong demand and rising prices.

China’s primary aluminium imports from Russia saw a notable increase. And reaching 1.06 million tonnes in the first 11 months of 2023. And marking a significant 178.3% rise over the previous year. China’s primary aluminium consumption was prediction to expand by 3.9% in the same period to 42.5 million tonnes.

Technically, there appears to be new buying activity in the market, as open interest increased by 24.28% to close at 3946 and aluminium prices increased by 0.05 rupees.

Resistance is now probably at 205.2, and the movement above could test 207.1. Support is identified at 202.1, with a potential test of 200.9.